It’s tax season again, which means another year of sharing sensitive information and managing tax return payments with the IRS. Both of these situations are prime opportunities for criminals to steal your information and money, so it’s best to be prepared.

Scammers may try to contact you by phone, text, or email posing as government or tax officials, or even tax preparation software. Here are some current examples you may see as you file your taxes:

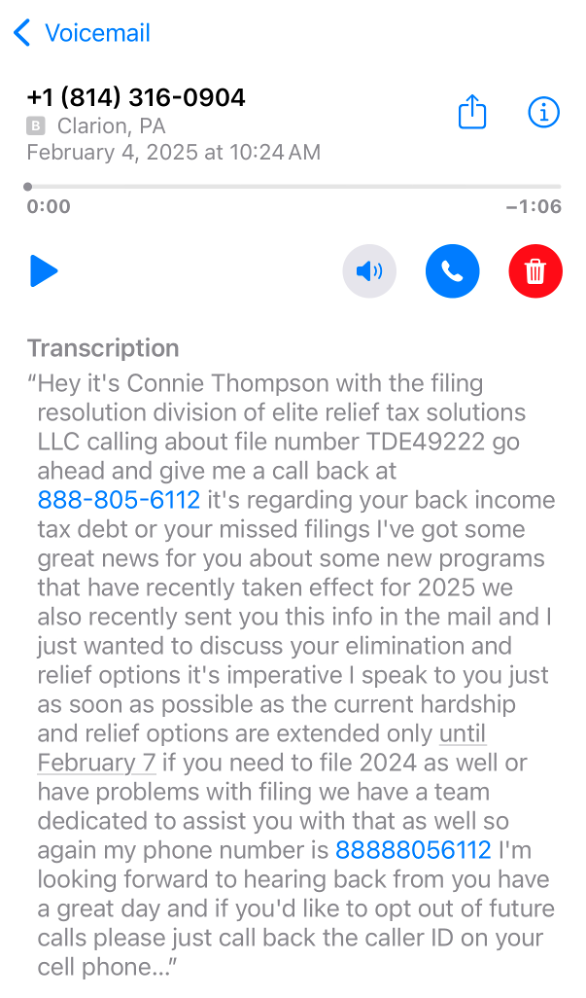

This voicemail transcription was left by a scammer posing as a tax professional trying to entice a target with details about money that may be owed to them. Note that information on refunds or payments is available on the IRS website:

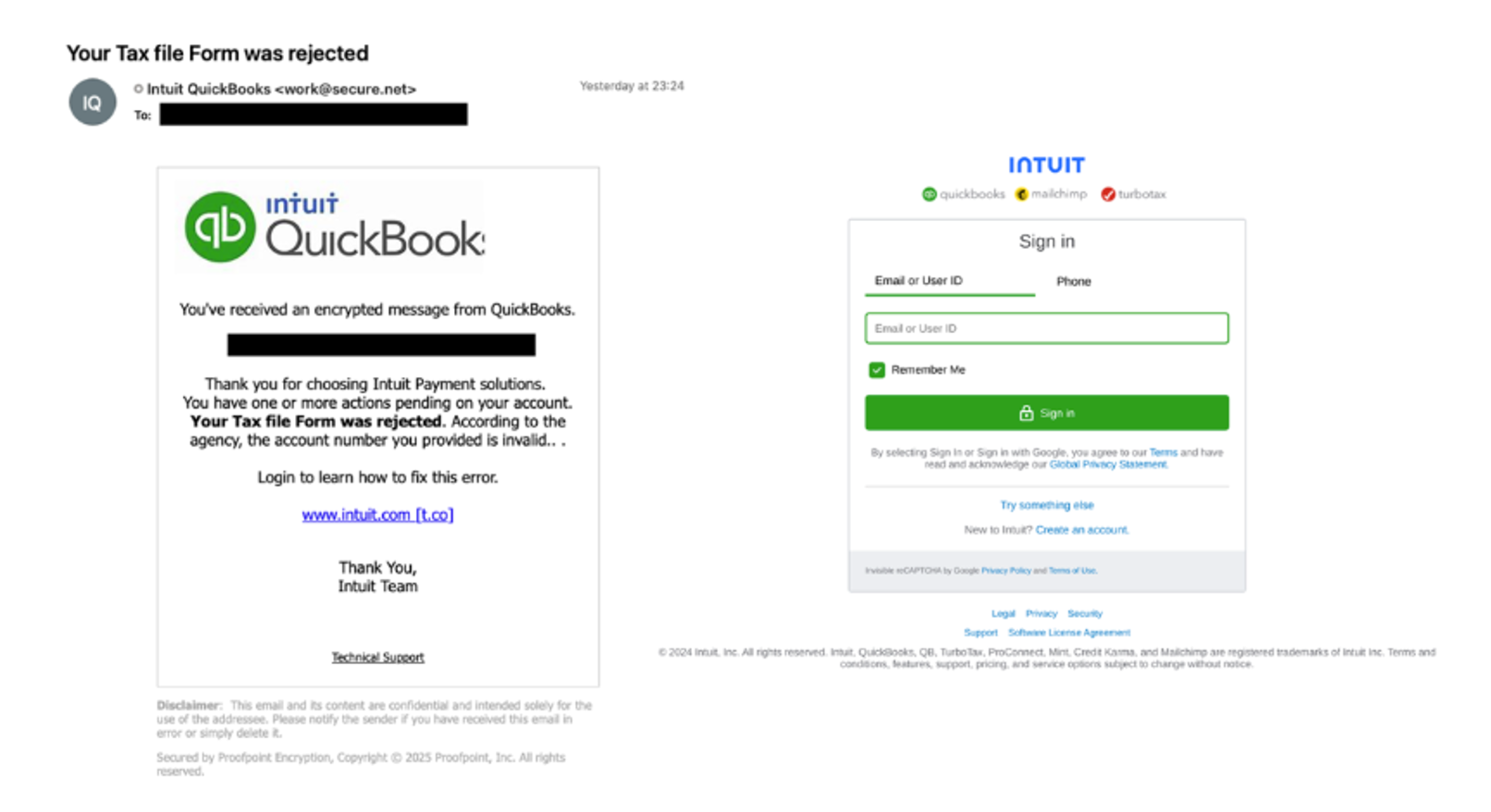

Cybercriminals can create phishing campaigns aimed to look like legitimate messages from applications like TurboTax. Notice how the sender in the message below does not have an Intuit or Quickbooks email address:

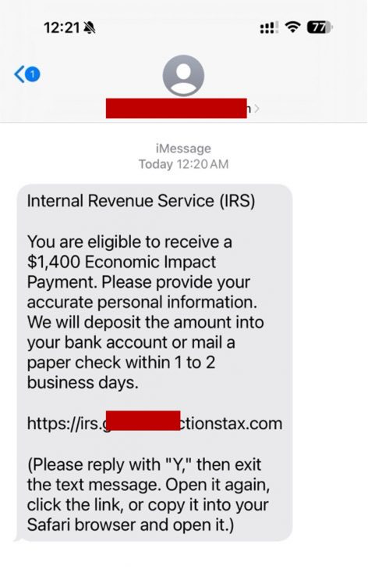

Text messages are becoming an increasingly common way for scammers to reach their victims. Remember that the IRS will only contact you via mail regarding payments.

The IRS will never reach out to you via text message, email, or social media to request payment. Read more about legitimate ways the IRS will contact you.

Verify your messages. If a message purporting to be from a government, financial, or tax agency seems suspicious, look up the company reaching out and call their office number to confirm its authenticity.

Add a layer of protection to your financial accounts. The IRS offers Identity Protection PINs to prevent someone else from using your SSN to file a return. Also, most financial institutions offer multifactor authentication to verify your identity when you log into your online accounts.

Keep track of your taxes with the IRS. Filing taxes early helps you beat scammers to claim your refund. You can also follow the status of your refund or pay a balance you owe directly on the IRS website.

Learn more about common scams and how to protect yourself with this short video:

If you suspect you’ve received a fraudulent message from someone purporting to be from the IRS, file a complaint with the:

You can also contact ITS Security for suspicious messages sent to your WCM accounts using Phish Alarm (for emails) and the Service Desk (for calls).

If you believe you have provided your confidential information (e.g., Social Security Number, financial records, etc.) during a phishing attempt, visit identitytheft.gov to report it to the IRS and FTC and create an action plan to begin protecting your identity.

Stay safe this tax season!